How would you like to have a whopping $1378 in your bank account at the end of 52 weeks? Imagine $1378 sitting in a bank account, earmarked for whatever you wish (maybe a vacation, maybe holiday gift giving, maybe a home remodeling project, maybe towards a new car, the list could go on and on).

Join us as we once again participate in the life changing (for us anyway) 52 Week Saving Challenge. The idea is simple, each week you put away a pre-determined amount of money into a separate bank account. This money is to remain untouched during the entire 52 weeks; if you stick to the plan you will have $1378 when we are finished.

We have done the 52 Week Saving Challenge going on 4 years now and it has totally transformed how we pay for our Christmas related expenses. We use the money we save to buy our holiday gifts and also to help pay for the holiday parties we host. This has been a blessing for us, and we are so excited about the idea of saving money that we are one again urging you to join us.

We’ll post weekly reminders for you when it is time to make the deposit, usually on Friday. The beauty of the program is that you can make small adjustments so that it works for you. If you happen to be paid every other week, maybe twice a week deposits would work best? You are in control of the plan; just be sure you get in the habit of making those deposits. We promise that you will be so grateful at the end of the 52 weeks when you have that wad of cash staring you in the face!

How to get started on the 52 Week Saving Challenge

Step 1

Decide where you will deposit your money. This could be any bank account you have. (We like to use an online bank account that is linked to a debit card because “out of sight” works for us. We use the 100% no fee Capital One 360 card, you can get a free account here. This is NOT a credit card!!) You can also keep the money at home in a bank, or maybe in an envelope. Whatever works for YOU.

Step 2

Commit to the plan.

You have two options with the 52 Week Saving Challenge:

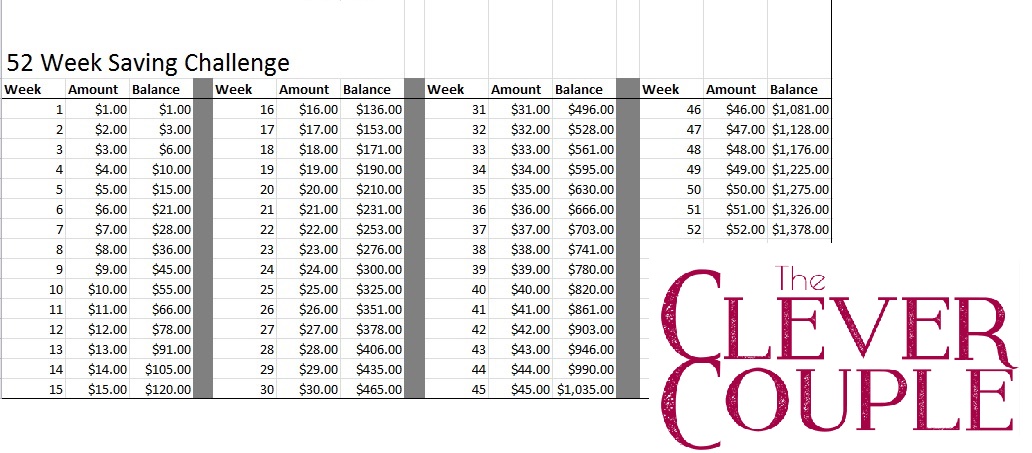

A) You can work the plan the traditional way starting with a $1 deposit on week #1, $2 deposit on week #2 and so on. This is the traditional plan and your deposits will increase as the year goes on. Keep in mind this means you will be making the largest payments in December (when most of us have added expenses in the budget already).

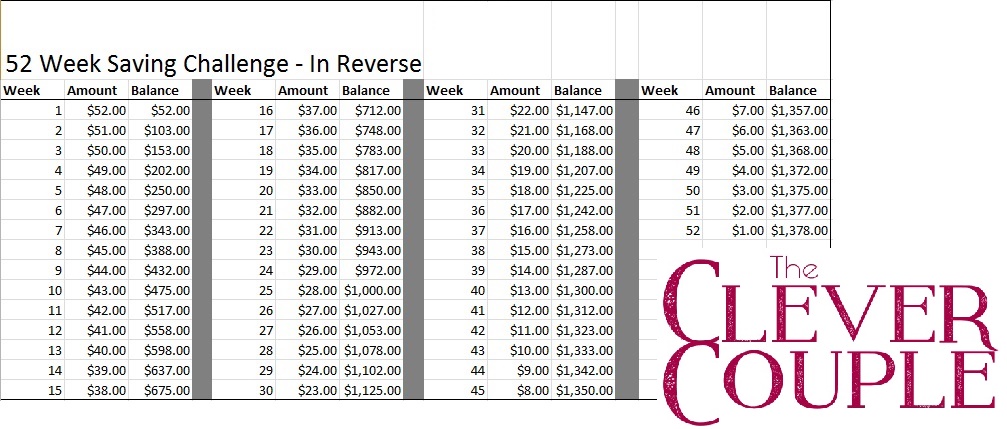

B) You can work the plan backwards with a $52 deposit on week #1, $51 deposit on week #2 and so on. This means you will be making the largest deposits right off the start but come December you will only be depositing a total of $10 for the final 4 weeks.

We prefer to work the plan backwards.

Step 3

Make the first deposit

Log into your bank, pull out your envelope or create the free online Capital One 360 account and make that initial deposit for week #1. You’ll be depositing $1 (the traditional plan) or $52 (the backwards plan).

You can do this – you can do this! What do you have to loose, right?

Here are some graphics to get you excited about how the funds in your account will grow:

Traditional 52 Week Saving Challenge deposit schedule

Backwards 52 Week Saving Challenge deposit schedule

We are so excited for an amazing 2017 ahead of us, and so excited to be saving money with you!