It is the most wonderful time of the year, as the song goes. We believe that too; we are huge Christmas people….and that means just like you we are busy in December. We’ve totally fallen off the bandwagon of the 52 Week Saving Challenge, but hopefully you have not.

What we are is GRATEFUL that up until mid November we were super disciplined with making our weekly deposits. Many of you followed along and are probably feeling the same emotions of gratitude and thankfulness. That extra money set aside each week really piles up, right?

How do you spend your savings?

We use our savings for our Christmas shopping. That means no credit card debt after the holidays (we’ve been there, done that many years ago and it stinks). What are you using your savings for?

Some people put the money away for a vacation or a big purchase (one reader used it to buy a new riding lawn mower, another as a down payment on a new vehicle). Or maybe you are just stockpiling the money to use as part of your Emergency Fund?

Backwards vs. traditional

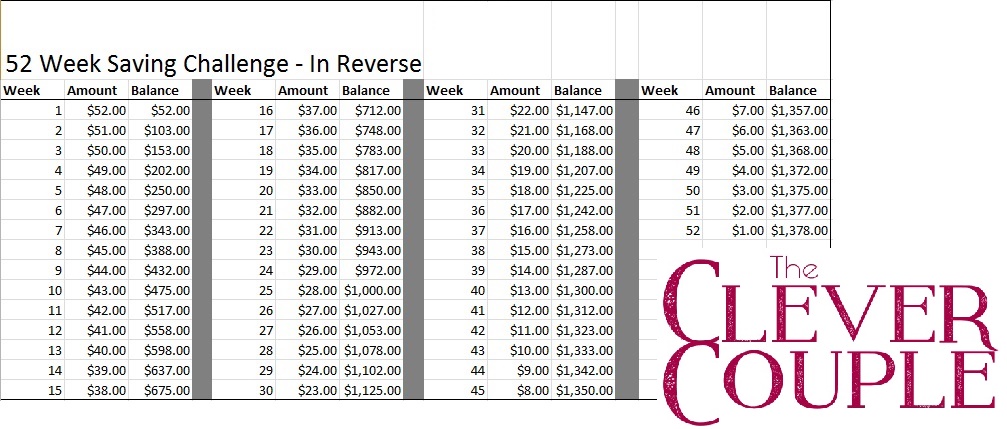

Each year when we introduce the new challenge we try to encourage you to work backwards. If you start off the year making the biggest deposits (week 1 is $52, week 2 is $51 and so on – see the chart below), missing deposits towards the end of the year doesn’t really affect your total too much.

We’ve missed weeks 43-48 (this is week 49), however that is only $47 missed. In the scheme of the big goal of $1378, $47 is not that big of a deal. On the other side, if you work the challenge traditionally missing weeks 43-48 means you are short $273.

See the big difference? Seriously, think about working the challenge backwards for 2018 …. you’ll be grateful you did.

Like we mentioned, this is week 49. Deposit $49 into your account, or just $4 if you are working the challenge backwards.