Imagine two months free homeowners insurance. Let me explain….I’ve never been happy to get a bill in the mail (or in my email inbox), especially a bill that is over $1000. Until now. Maybe happy is the wrong word; maybe confident is better. Now that we are one plus year into our life changing ways of handling money and using a written budget things are different. (Our money handling system is strongly based on Dave Ramsey’s Financial Peace University classes that we attended in early 2016 and that we have detailed in our previous posts).

The email arrived from our homeowner’s insurance company (we are with Allstate) and when I clicked to open the bill I was happy because everything stayed the same. There were no policy changes, which made it simple. I saw the amount due and I excitedly went to my “house insurance” budget envelope to see if our calculations were right. If they were, we would have this amount of cash on hand to pay the bill in full. Every month we set aside a certain amount of cash ($120) for house insurance in our written budget. I was giddy with excitement when I counted up the cash and discovered we actually had more than the required amount in the envelope. (Probably due to the credit we received from Allstate for being claim-free).

It is hard to put into words the sense of accomplishment and self satisfaction the process of being intentional with our money brings. Knowing that we have routinely budgeted for this expense, along with countless other household expenses, makes my heart happy. No longer is there a mad scramble when a bill arrives wondering how we will pay it or what we need to adjust to pay the bill. It’s routine, it’s simple and it is effective. If you are not using a written budget every month, or a free app like Every Dollar, you should be.

Our homeowners insurance details

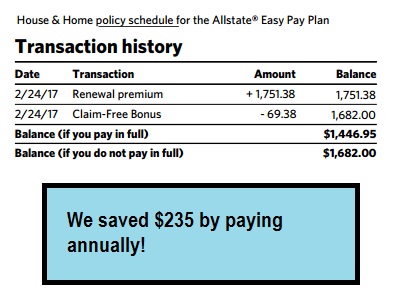

Back to the homeowners insurance bill – another wonderful thing I noticed is that because we pay annually we saved $235.

We used to be on the monthly easy pay plan as Allstate called it, and we paid a certain amount each month towards our yearly premium. It wasn’t until we took Financial Peace University and became more aware of examining our expenses that we discovered we could save a large amount of money on our auto insurance and our homeowners insurance if we left the monthly payment program and paid annually.

A savings of $235 is huge; when you look at what we pay a year for the policy ($1446.95) and divide that amount by 12 months it works out to $120 a month. Saving $235 a year is just a smidgen under two months free homeowners insurance!

We are sharing this information with you to make you realize that you too may be missing a substantial savings on insurance if you are using a monthly payment plan. We are with Allstate, but over the past 20 plus years we have had insurance with different carriers and as far as I can remember, they all offered some sort of monthly payment plan. If you are making monthly payments, call your insurance agent and ask what you would save on your homeowners insurance and auto insurance if you pay annually. Some companies may even allow you to pay semi-annually and still save some money.

We’d love to hear your results of the investigation; comment below with what you discovered.