During week 7 of Financial Peace University, or FPU as it is commonly known, we learned so very much. Honestly, we are loving our time spent in class and are amazed at how quickly the 9 weeks are going by. This coming week is our last class already!

I think because we are enjoying it so much and learning so many things that we can implement immediately to improve our financial lives, the time is flying by. When we initially signed up for Dave Ramsey’s FPU class the 9 weeks seemed like a large commitment to us both. However, we’ve attended every single class and walked away with a wealth of information. We would recommend this class for anyone that is ready to take control of their finances and achieve the dream of being debt free with savings and retirement ready. Dave’s premise of “live like no one else so later you can live like no one else” have become the mantra of our lives.

We have “drank the kool-aid” and are on board, 100%.

It has already changed our lives, our outlook on money and our ideas for our future. This is powerful, powerful stuff. Learn more about FPU class and find a class in your area (you can take the class in person in your area or online).

In continuing with our FPU updates, here are our takeaway moments from week 7.

Financial Peace University Week 7 – Retirement and College Planning

Baby step 4 of Dave’s plan is to start to begin saving 15% of your income for retirement. To recap:

Baby step 1: save $1000 for an emergency fund

Baby step 2: work the debt snowball, paying off everything except the mortgage from smallest to largest

Baby step 3: save 3 to 6 months of expenses in a fully funded emergency fund

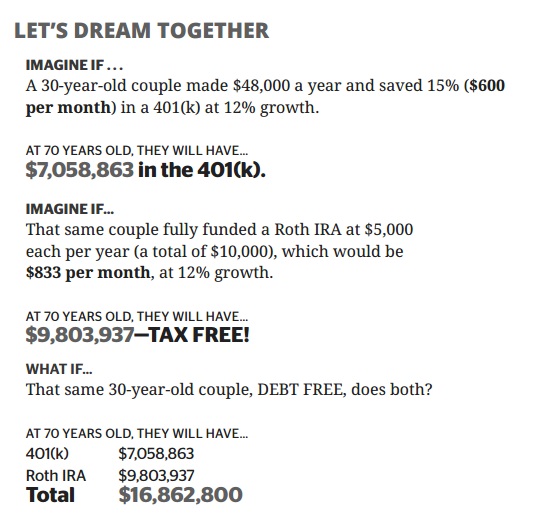

Once you have your fully funded emergency fund in place it is time to start planning for the future. Dave keeps investing simple, and is in it for the long haul. One of the biggest things we learned was that starting early makes a huge difference.

Check out this example, courtesy of DaveRamsey.com:

But it is never too late to start investing!

We started to invest about 18 years ago, heavily investing my income when I worked my full time job in the “outside world”. We plugged away at that plan for quite some time until life happened. Like all of you, things in our life have not always gone as planned and there have been times we have had to step off our investing plan. We bought a house that required total remodeling (that we did ourselves for the most part), I quit my full time job to work from home, we launched a new business, we battled cancer, etc. Just like you – things happened.

However we are now back on track and are aiming to begin to achieve Baby Step 4.

Because we do not have children, we do not have to think about funding college. We know that many of you do, and Dave speaks about that at great length in week 7. You can also explore a wealth of free information and articles on Dave’s website! Just check out the investment section on DaveRamsey.com. Dave also writes a blog that has a bunch of investing information.

Not only did Dave do an excellent job of explaining how your money can work for you if you invest it, he walked through his strategy for investing and explained to us how he diversifies his investments for the best rate of return. We plan to follow suit and we are excited to have an upcoming meeting with one of Dave’s Endorsed Local Providers in April to discuss our investments and our plan for the future.